Debt collection has always played a vital role in helping businesses like banks, microfinance institutions, and service companies maintain a healthy cash flow. However, with global consumer debt reaching over $300 trillion according to the Institute of International Finance, businesses are under even more pressure to recover outstanding payments efficiently. Unfortunately, traditional methods often fall short—relying on manual processes that are not only slow and prone to errors, but also result in recovery rates lower than modern, automated alternatives. These inefficiencies drive up costs and reduce success rates, leaving businesses searching for smarter, more streamlined approaches.

In today’s competitive market, optimizing debt collection processes with advanced tools and software is no longer just a recommendation but a necessity. Leveraging debt collection solutions is crucial in streamlining operations, enhancing compliance, and improving customer satisfaction. Solutions like 8×8’s debt collection solution provide the comprehensive toolset needed to manage debt recovery effectively while maintaining secure and efficient communication.

Why Optimizing Debt Collection is Crucial in 2024

The debt collection landscape in 2024 is more complex than ever before. With rising consumer debt and fluctuating economic conditions, businesses—especially banks and microfinance institutions—are experiencing higher default rates, according to the Science Direct.

These defaults result in bad debt, which directly impacts a company’s bottom line. Poorly managed debt collection not only delays payment recovery but can also negatively impact customer experience (CX) due to inconsistent follow-up and ineffective communication.

Traditional, manual methods of debt collection also expose companies to legal and compliance risks. As regulatory frameworks such as GDPR (General Data Protection Regulation) and PCI-DSS (Payment Card Industry Data Security Standard) become more stringent, businesses that do not comply face potential penalties and reputational damage. Inadequate data security or non-compliant processes can lead to financial losses and erosion of trust, especially in industries like banking and finance, where data sensitivity is paramount.

8×8’s automated debt collection solution streamlines the entire recovery process, from sending initial reminders to managing payment collections and follow-ups. By leveraging advanced automation and AI-powered tools, the platform reduces manual effort, increases engagement, and accelerates debt recovery cycles. Its seamless integration into existing business systems ensures a more efficient, data-driven approach, allowing businesses to focus on growth rather than chasing unpaid invoices. With real-time analytics and custom workflows, you can optimize your collection strategy, all while maintaining compliance with industry regulations.

Time and Cost Savings

One of the most immediate and noticeable benefits of automation is time and cost savings. Manual debt collection requires significant human resources to send reminders, track payments, and handle disputes, all of which consume time and increase operational costs. By automating these processes, businesses can drastically reduce the need for manual intervention. This saves time, minimizes staffing costs, and allows employees to focus on higher-value tasks.

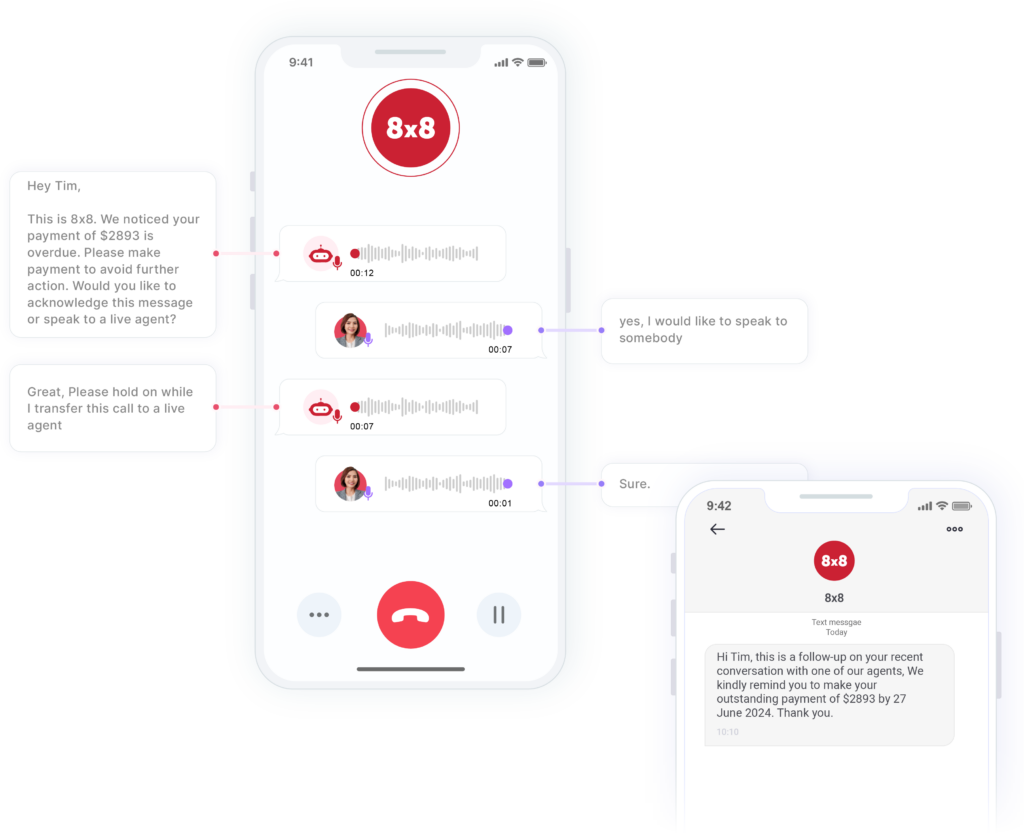

8×8’s automated debt collection platform excels in automating such tasks, enabling businesses to cut down on the overhead associated with manual debt recovery. From automated voice reminders to follow-up SMS messages, the platform takes care of these tasks with minimal human oversight, ensuring the process is both smooth and cost-efficient.

Increased Engagement and Accessibility

Automation doesn’t just reduce human error—it plays a critical role in ensuring continuous engagement with debtors, even when human agents are unavailable. Missed opportunities due to limited working hours can drastically affect recovery rates, but with an automated system, businesses can engage with debtors 24/7, maximizing accessibility and improving response rates.

8×8’s platform ensures that no opportunity is missed by enabling automated, round-the-clock communication. With advanced data processing capabilities, the system accurately tracks payments and customer interactions, allowing businesses to stay on top of every debt collection case without relying solely on human agents. This not only enhances engagement but also reduces the burden on agents, enabling them to focus on more complex cases while ensuring seamless communication at all times. Additionally, by utilizing number masking and rotating phone numbers, businesses can further boost debtor engagement and increase conversion rates by disguising their caller ID, making interactions more effective.

Seamless Integration with CRM and Financial Systems

Another key advantage of automation is its ability to seamlessly integrate with existing CRM (Customer Relationship Management) systems. This integration enables businesses to maintain a unified platform for managing customer data and communication records, creating a more holistic view of each debtor.

8×8’s debt collection platform integrates seamlessly with most CRMs, allowing businesses to continue using their preferred systems while benefiting from enhanced debt collection functionalities. By integrating debt collection data into the CRM, companies can improve the overall workflow and reduce the likelihood of information silos or data inconsistencies.

Speech Recognition and Seamless Call Summaries

Automation in debt collection goes beyond simple process efficiency—it enhances the way businesses interact with customers. With advanced speech recognition capabilities, businesses can capture valuable insights from conversations, allowing for better understanding and tracking of customer interactions. After each call, a detailed session summary is automatically generated and delivered via webhook to the customer’s platform, providing a full transcript and key call details. This streamlined integration enables businesses to maintain a comprehensive record of interactions, ensuring compliance and improving future engagement strategies.

8×8’s solution empowers businesses with these tools, allowing for seamless integration into existing workflows. By capturing and analyzing speech, businesses can optimize their communication strategies, ensuring timely follow-ups and more effective debt recovery processes.

Scalability for Growing Businesses

For growing businesses, scalability is key. As companies expand, so too does the volume of debt that needs to be managed. An automated debt collection system can easily scale to meet these demands, allowing businesses to handle an increasing number of customers without sacrificing efficiency.

With 8×8’s cloud-based platform, businesses can easily scale their debt collection operations to accommodate growth. The platform’s flexible, cloud-based infrastructure makes it easy to add new users, processes, or integrations without the need for significant upfront investment.

How Debt Collection Software Enhances Customer Experience (CX) for Businesses

In today’s customer-centric world, improving customer experience (CX) is key to building long-lasting relationships and increasing brand loyalty. Optimizing the debt collection process can significantly enhance CX, even when customers are in debt.

Automated Reminders and Multi-Channel Communication

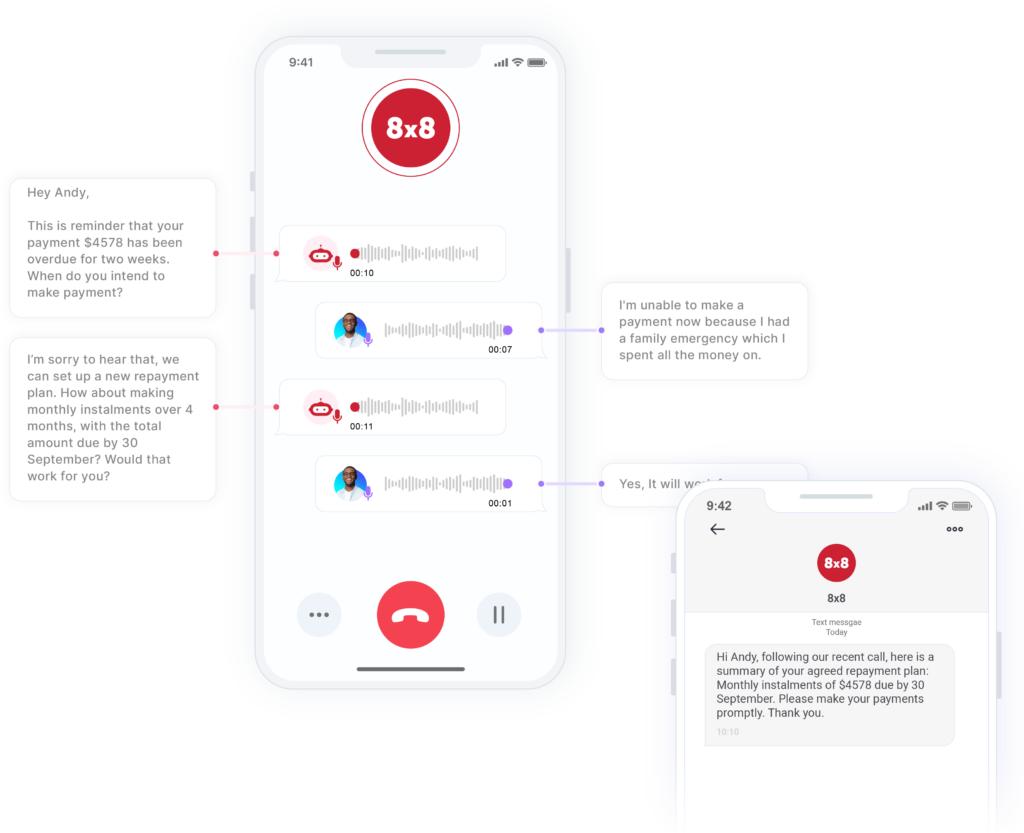

By providing automated reminders and enabling communication through voice bots and SMS, businesses can efficiently reach their customers and ensure timely responses. This approach helps streamline the debt collection process, improving engagement and increasing the likelihood of successful payments.

8×8’s platform allows businesses to communicate with customers across multiple channels, improving engagement and increasing the likelihood of debt recovery. These personalized reminders ensure that customers are always aware of their outstanding payments and can act quickly to resolve their debts.

Personalized Interactions Using Customer Data

By leveraging customer data, businesses can create more personalized interactions that build rapport with customers. Instead of treating debt collection as a transactional process, businesses can use insights from customer data to provide tailored solutions that meet each customer’s unique needs.

8×8’s debt collection platform seamlessly integrates with CRMs, enabling businesses to create personalized interactions based on customer data. By turning potentially negative situations into positive, customer-centric experiences, businesses can foster stronger relationships and encourage timely payments. Additionally, 8×8 provides recordings of voice interactions, which are analyzed using Speech Pattern Recognition (SPR) to ensure accurate logging of commitments and promises made during calls. This helps streamline follow-ups and ensures smoother, more efficient debt recovery processes, improving overall outcomes.

Choosing the Best Debt Collection Solution: Key Considerations

Choosing the best debt collection solution for your business is an important decision that can have a lasting impact on your operations. Here are some key factors to consider when selecting the right solution.

Essential Features: Automation, Integration, Security, and Scalability

When evaluating debt collection solutions, it’s important to ensure that the system offers the features your business needs to succeed. Automation is essential for reducing manual tasks, while integration with your CRM and financial systems ensures that data flows seamlessly between platforms. Security is also critical, particularly when dealing with sensitive financial data. Finally, the software should be scalable to accommodate future growth.

8×8’s debt collection platform offers all these features, providing a comprehensive solution that can grow with your business and meet your evolving needs.

Vendor Reputation and Customer Support

The reputation of the software vendor is another important consideration. Look for a provider with a proven track record of success and a strong commitment to customer support. The best vendors will offer responsive support teams that can quickly address any issues you encounter.

8×8 is a trusted name in the industry, known for its reliable customer support and commitment to innovation. Businesses that choose 8×8 can rest assured that they will receive the assistance they need when they need it.

Compatibility with Industry-Specific Needs

Different industries have unique requirements when it comes to debt collection. For example, banks and financial institutions face stringent regulatory and compliance demands, particularly around data privacy and security. Ensuring the protection of sensitive customer information is critical, especially with regulations like GDPR and local data privacy laws in place. Smaller businesses, on the other hand, may prioritize ease of use and cost-effectiveness.

Choosing a solution that not only fits your industry’s specific needs but also aligns with compliance requirements is essential. 8×8’s solution offers a flexible, customizable solution that caters to businesses across sectors—whether it’s banking, finance, retail, or healthcare. Additionally, with data centers strategically located in Asia, Indonesia, and Europe, 8×8 minimizes data latency and ensures compliance with data residency regulations, giving businesses peace of mind that their data is secure and accessible in line with local laws.

Conclusion

In conclusion, optimizing debt collection processes offers significant benefits for businesses in terms of cost-efficiency, customer satisfaction, increased conversions/engagement and compliance. Implementing an automated debt collection system like 8×8’s debt collection solution ensures smoother operations, better decision-making through data analytics, and secure communications.

To stay competitive, businesses must explore and adopt these cutting-edge debt collection solutions. Platforms like 8×8 provide a comprehensive toolset for businesses seeking to enhance their debt recovery efforts, ensuring secure, efficient, and compliant debt collection processes that can significantly improve financial health and customer relationships. Find out more here or reach out to an expert at cpaas-sales@8×8.com to find out more.