While us customers are enjoying the convenience and ease of today’s digital banking, mobile payments, and online transactions, financial institutions face an ever-growing challenge: the rise of financial fraud. According to recent reports, financial institutions globally lose billions of dollars each year due to fraudulent activities.

With that said, authentication has emerged as the first line of defense in safeguarding against these threats. Strong, multi-layered authentication methods are crucial for preventing unauthorized access and fraudulent activities. 8×8, a trusted provider of secure communication solutions, offers robust tools to protect financial institutions from fraud while ensuring seamless customer experiences. From OTP services to multi-factor authentication (MFA), 8×8’s solutions are designed to meet the unique security needs of the financial sector.

What Exactly is Fraud in the Finance Industry?

As imposing as it sounds, fraud cases are more pervasive and multifaceted than one might think. Some of the most common forms of financial fraud include:

- Identity Theft: Criminals use stolen personal information to access bank accounts, make unauthorized transactions, or apply for credit.

- Account Takeovers: Hackers gain control of legitimate user accounts, often using credentials obtained through phishing or data breaches.

- Phishing Attacks: Fraudsters trick individuals into providing sensitive information such as usernames, passwords, or credit card details through deceptive emails or websites.

- Insider Fraud: Employees or trusted insiders exploit their positions to commit fraud, such as misappropriating funds or stealing confidential data.

The finance industry is a prime target for these attacks due to the high value of financial data and the growing reliance on digital platforms. Online banking, mobile transactions, and contactless payments offer convenience but also create vulnerabilities for cybercriminals to exploit. For both financial institutions and their customers, the risks extend beyond financial loss. A single breach can damage an institution’s reputation, lead to legal repercussions, and erode customer trust.

Best Practices in Preventing Fraud

There are various ways to guard against fraud, and some are more effective than others. One of the key fraud prevention strategies is robust authentication, which is vital for defending financial institutions against these growing threats. Authentication verifies a user’s identity before granting access to sensitive systems or authorizing financial transactions, creating a security barrier that fraudsters find difficult to bypass.

Multi-Factor Authentication (MFA)

Multi-factor authentication (MFA) is one of the most effective methods for preventing fraud. MFA requires users to present multiple forms of identification before accessing an account or completing a transaction, making it significantly harder for unauthorized individuals to gain access.

For example, a user may need to enter a password (something they know) and a one-time password (something they receive), or use biometric data such as a fingerprint (something they are). By layering these methods, financial institutions can reduce the risk of fraud substantially.

8×8’s Descope platform allows for seamless integration of MFA into existing systems, providing financial institutions with a powerful tool to authenticate users securely and frictionlessly. Descope simplifies the process of implementing MFA while ensuring top-tier security for users.

OTP as a Strong Authentication Method

One-time passwords (OTPs) are another proven method for securing transactions and authenticating users. OTPs are time-sensitive, single-use codes that provide an extra layer of security during logins or transactions. Given their temporary nature, even if a hacker intercepts an OTP, they cannot reuse it.

The 8×8 Verification API solution offers businesses a reliable OTP solution that integrates easily into their existing systems. With real-time OTP generation and delivery across multiple channels including SMS, WhatsApp, Viber and voice, financial institutions can ensure that sensitive transactions remain secure.

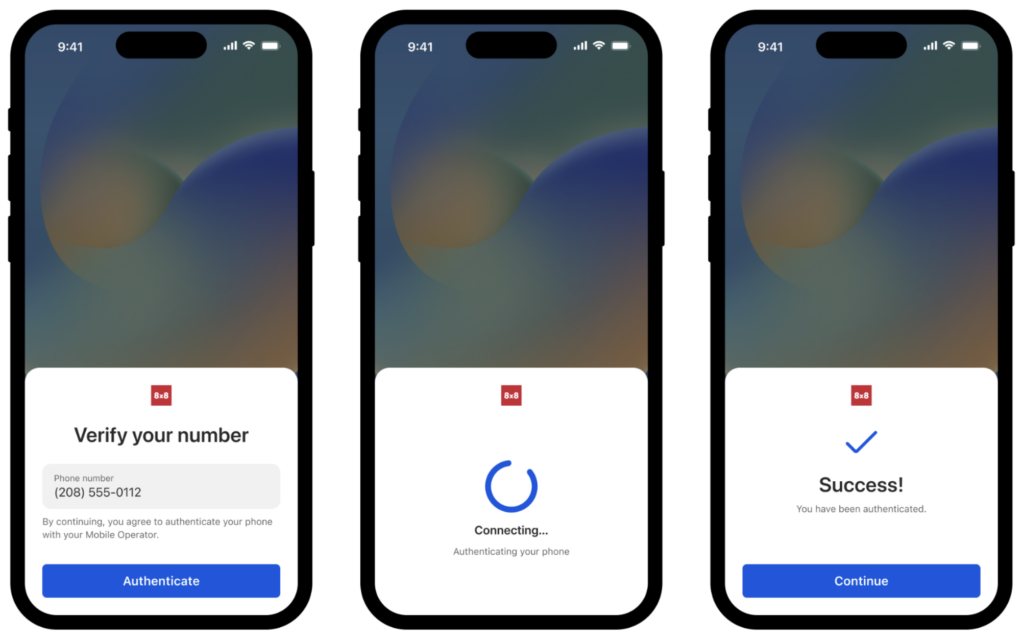

Enhanced Authentication

While most authentication methods provide a powerful layer of security, few of them offer intuitive and friction-free experience as offered by 8×8’s Silent Mobile Authentication. This security solution enables you to streamline authentication processes by quietly activating it’s verification system upon user login, sign up, or transaction without interrupting the users. Not only does it elevate customer experience, but by bypassing traditional methods like SMS OTPs, 8×8’s Silent Mobile Authentication can help to reduce security costs in the long run.

Invest in a fraud prevention solution

SMS fraud is one of the most financially damaging experiences to both your business and your customers. A recent ENEA report stated that ‘4.8% of global messaging traffic is fraudulent, with brands incurring costs of $1.16 billion due to fraudulent messages’.

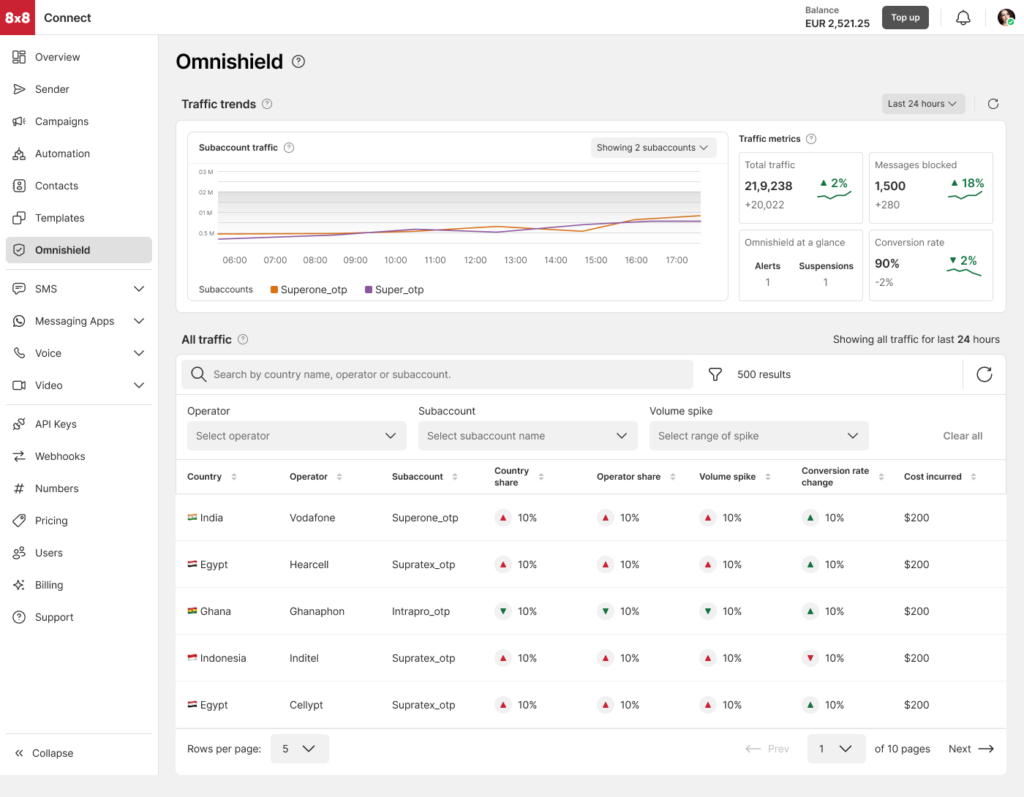

Enter 8×8 Omni Shield – pioneered to detect and prevent SMS fraud through intelligent monitoring and real-time traffic analysis that are equipped to track, detect, and trigger alerts of potential fraud activity.

Benefits of Robust Authentication in Finance

Protection Against Fraud

By implementing strong authentication and fraud prevention methods, financial institutions can prevent various types of fraud, from account takeovers to unauthorized transactions. With 8×8’s security tools like Omni Shield and Descope, financial institutions can build a comprehensive fraud prevention framework.

Compliance with Regulatory Standards

In the finance industry, compliance with global regulations such as PSD2 (Payment Services Directive 2), AML (Anti-Money Laundering), and KYC (Know Your Customer) is mandatory. Financial institutions must adhere to stringent security standards to avoid fines and legal consequences.

8×8’s solutions are designed with compliance in mind. They ensure financial institutions meet regulatory requirements while maintaining secure customer experiences. 8×8 also operates data centers across Asia, Indonesia, and Europe, ensuring compliance with regional data residency laws and minimizing latency.

Improved Customer Trust and Retention

Customer trust is paramount in the finance industry. Financial institutions that prioritize security are more likely to build long-term relationships with their customers. Strong authentication not only protects customers but also fosters confidence, knowing their financial data is secure.

By implementing solutions like Descope from 8×8, businesses can strike the right balance between security and convenience, reducing friction in the user experience while maintaining top-tier protection.

Emerging Trends in Fraud Prevention and Authentication

The good news is, as the finance industry is rapidly evolving, so are the methods for preventing fraud. Some of the notable and effective methods to combat frauds are:

Real-time Data Intelligence

Real-time monitoring and analytics are critical for fraud prevention. 8×8’s Omni Shield enhances fraud detection by using real-time data and phone number intelligence to analyze traffic patterns and detect suspicious activity. This proactive approach helps financial institutions stop fraud before it escalates.

Blockchain for Secure Transactions

Blockchain technology is also being explored as a means of securing financial transactions. By creating tamper-proof transaction records, blockchain can further strengthen authentication processes in the finance industry. Future authentication solutions may incorporate blockchain to enhance security and create a more robust digital ecosystem.

Omnichannel Authentication

Financial institutions are increasingly adopting omnichannel authentication methods to provide seamless security across multiple platforms. Whether a customer is using a mobile app, web browser, or making a phone call, omnichannel authentication ensures a unified, secure experience.

8×8’s Verification API delivers OTPs and authentication notifications across SMS, WhatsApp, Viber, and voice, providing a flexible and secure authentication solution across channels.

How 8×8 Supports Financial Institutions in Preventing Fraud

With our selection of advanced tools, 8×8 provides financial institutions with secure, scalable, and easy-to-integrate solutions that enhance fraud prevention. From Descope to Omni Shield to Verification API, 8×8’s comprehensive suite of tools ensures that businesses are well-protected against fraud while ensuring:

Seamless Enterprise Integrations

8×8’s solutions easily integrate with existing infrastructures through APIs, SDKs, webhooks, and popular CRM or Contact Centre softwares. This effortless integration ensures that financial institutions can adopt advanced authentication tools without disrupting current systems or workflows.

Scalable Infrastructure

Financial institutions benefit from 8×8’s scalable, globally distributed architecture. Whether dealing with routine operations or high-volume traffic, our adaptable infrastructure guarantees performance and reliability, ensuring businesses can handle growing customer interactions without compromising security.

Actionable, Visual Insights

8×8 offers powerful, visual analytics that provide real-time, actionable insights. These insights help financial institutions better understand customer behavior, optimize engagement, and enhance fraud detection strategies, empowering them to stay ahead of potential threats.

Future-Proof Your Institution Against Evolving Digital Threats

8×8 empowers financial institutions to effortlessly implement robust authentication practices. By partnering with 8×8, you strengthen security, minimize fraud risks, and build unwavering customer trust—all while ensuring seamless, secure experiences for your clients. In an industry where security is everything, proactive security measures are key to protecting customer trust and keeping digital experiences secure.

Ready to elevate your financial institution’s security? Reach out to an expert at cpaas-sales@8×8.com to find out more.