The insurance game is changing fast, and it’s not waiting for anyone to catch up. Customer expectations are shifting, tech is pushing the boundaries, and competition is ruthless. The old ways of doing business just won’t cut it anymore in this digital-first world.

Today, 60% of insurance customers prefer digital interactions over traditional channels, according to McKinsey. Meanwhile, poor customer experiences risk a $170 billion loss globally. This isn’t just a wake-up call—it’s a red alert.

Here’s the truth:

- Broken communication systems are wasting time and money.

- Claims drag on forever, leaving policyholders frustrated.

- Lack of real-time interaction? That’s a fast track to a bad customer experience.

To stay in the game, insurers need to level up. The answer? Omnichannel communication. CPaaS (Communications Platform as a Service) is the tool insurers need to eliminate inefficiencies and deliver a seamless, personalized customer experience.

Unlocking the Power of Omnichannel Communication for Insurers

Effective communication lies at the heart of the insurance industry, where timely and reliable exchanges can make all the difference. SMS has always been the go-to, but that’s just the beginning. In today’s digital world, it’s not enough to just send a text.

That’s where CPaaS comes in, empowering insurers to expand beyond SMS to dive into the modern era with WhatsApp, Viber, and other messaging apps, along with voice and video – creating richer, more engaging interactions that meet the demands of today’s tech-savvy customers.

In the following section, we’ll explore how omnichannel communication for insurers—including messaging apps, video, and voice—transforms communication, boosts engagement, and enhances the customer experience.

Transforming Insurance Communication with SMS Solutions

SMS is a powerful, fast, and accessible tool for insurers, boasting an open rate over 90%. It guarantees critical messages reach policyholders quickly, making it perfect for urgent updates. When integrated with CPaaS, its capabilities expand further:

- Streamlined Claims Updates: Automate notifications to keep policyholders informed, enhancing transparency and reducing frustration.

- Policy Reminders: Notify customers about premium due dates, renewals, or policy changes to prevent lapses.

- Two-Way Communication: Facilitate quick inquiries, claim submissions, or appointment scheduling for seamless interaction.

- Personalized Messaging: Leverage customer data to send tailored updates, fostering deeper engagement.

- Universal Accessibility: SMS works even in areas with limited internet access, ensuring no customer is left out.

By using SMS for claim updates, policy notifications, OTP verification, and renewal reminders, insurers can modernize communication and enhance customer satisfaction.

Revolutionizing Insurance Interactions with Messaging Apps

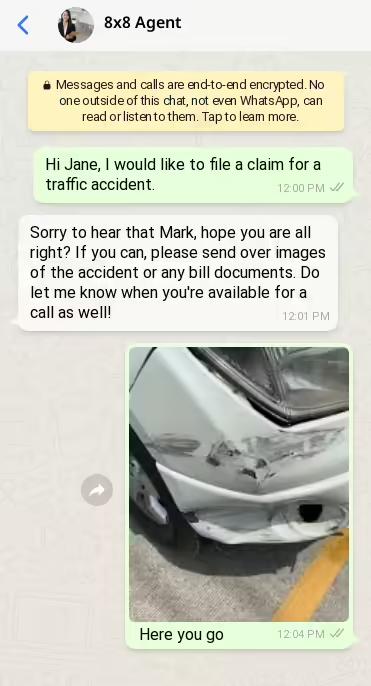

Customers today expect communication through their preferred platforms. CPaaS enables insurers to integrate popular messaging apps like WhatsApp, Viber, and others, offering:

- Real-time support: Address inquiries instantly through app-based messaging.

- Rich media integration: CPaaS allows insurers to share images, PDFs, or video explanations directly through messaging apps.

How Messaging Apps Elevate Customer Experience in Insurance

- Enhanced Customer Experience: Messaging apps allow insurers to engage customers through platforms they use daily, ensuring a more personalized and convenient experience.

- Reduced Response Times: Instant messaging through apps enables insurers to respond to inquiries faster, resolving customer issues in real time.

- Sharing Rich Content: Messaging apps support the delivery of rich media, such as documents, contracts, and videos, streamlining communication and ensuring clarity.

The Vital Role of Voice Communication in Modern Insurance

Voice is still the most personal, direct way to connect with customers. It builds trust, gets emotions across, and solves problems on the spot—making it a must-have for customer engagement. Today’s voice tech, powered by Voice APIs, takes it up a notch, connecting across multiple touchpoints and adding game-changing features like callback requests, voicemail-to-email, and 24/7 hotline support. It’s all about delivering a smooth, no-hassle experience that keeps customers coming back.

Benefits:

- For Customers: Improves response times by integrating voice into mobile apps or websites, allowing seamless switching between digital and voice support.

- Example: A customer requests a callback via a mobile app and receives a prompt follow-up without needing to wait in a call queue.

- For Insurers: Reduces costs by optimizing call handling and ensures consistent communication across channels, increasing scalability and customer satisfaction.

Enhancing Service Efficiency with Interactive Voice Response (IVR) Systems

IVR systems allow customers to interact with automated menus to resolve queries or retrieve information without needing a live agent.

Benefits:

- For Customers: Offers 24/7 self-service for routine inquiries like checking claim statuses, premium due dates, or policy details. This reduces wait times and enhances convenience.

- Example: A policyholder uses the IVR system to confirm the approval of their claim at any time of day, without waiting for office hours.

- For Insurers: Enhances operational efficiency by automating repetitive tasks, reducing the burden on customer service teams, and cutting costs.

The Role of Video Communication in Insurance

Video is a game-changer for building real, interactive connections. It mixes visuals and conversation, helping businesses engage customers, build trust, and personalize every interaction. Perfect for consultations, video lets agents deliver real-time demos, face-to-face chats, and collaborative problem-solving. It’s the ultimate tool for boosting customer experience.

Video consultations let agents offer tailored, face-to-face guidance—whether it’s breaking down policy options, clarifying claims, or walking through complex coverage details.

Benefits:

- For Customers: Builds trust and minimizes misunderstandings by allowing real-time, interactive explanations.

- Example: An agent walks a customer through the steps to submit a claim, ensuring they provide all required documents correctly.

- For Insurers: Improves customer retention by fostering stronger relationships and reduces repeat inquiries, saving time and resources.

Remote video support also enables field agents to connect with back-office experts to resolve claims or inspect damages in real time.

Benefits:

- For Customers: Speeds up the resolution process by addressing issues on the spot without requiring multiple visits.

- Example: A customer shows their property damage via a video call with an agent, expediting claim verification.

- For Insurers: Reduces travel costs for field agents and minimizes the time required for claim assessments, improving overall efficiency.

Revolutionizing Insurance with 8×8 CPaaS Solutions

In a fast-evolving insurance landscape, 8×8 CPaaS empowers insurers to deliver seamless, efficient, and customer-centric communication while meeting regulatory and security demands. Here’s how:

1. Omnichannel Two-Way Messaging

8×8 CPaaS integrates SMS, voice, video, and popular messaging apps like WhatsApp and Viber, enabling insurers to provide a unified communication experience across platforms.

- Benefits for Customers: Ensures policyholders can interact via their preferred channels, improving satisfaction and engagement.

- Benefits for Insurers: Streamlines workflows, reduces communication silos, and ensures consistent messaging across platforms.

2. Fraud Prevention and Authentication Solutions

8×8 CPaaS also offers authentication and fraud prevention solutions, enabling critical support to insurers in maintaining security and trust. Solutions like One-Time Passwords (OTPs) and Omni Shield secure sensitive transactions and verify user identities.

- Benefits for Customers: Enhances trust by safeguarding personal data and ensuring secure interactions.

- Benefits for Insurers: Reduces fraudulent activities and compliance risks, improving operational integrity.

3. Data Residency Compliance

8×8’s regional data centers in Asia, Europe, the US, and Indonesia ensure low latency and compliance with regional data protection laws. Insurers can be rest assured that customer data is stored securely while meeting location-specific regulatory requirements.

- Benefits for Customers: Assurance that their data is handled securely and locally.

- Benefits for Insurers: Compliance with regulations like GDPR or Indonesia’s PDP law reduces legal exposure and builds customer trust.

4. Enterprise Integrations

8×8 CPaaS easily integrates with APIs, SDKs, webhooks, Contact Center, and CRM platforms to enhance operational efficiency.

- Benefits for Customers: More personalized and efficient service through connected systems.

- Benefits for Insurers: Streamlined operations, faster deployment of new communication features, and better data utilization for customer insights.

5. Scalable Infrastructure

8×8 CPaaS is built to support both small insurance agencies and large enterprises, offering high availability, adaptable architecture, and global reach.

- Benefits for Customers: Reliable, uninterrupted communication during critical times like natural disasters or claims surges.

- Benefits for Insurers: Scalability ensures the system grows with their business needs while maintaining performance and reliability.

6. Secure and Compliant

8×8 CPaaS meets the highest security standards with certifications like SOC 2 Type II, ISO 27001, HIPAA, FISMA, and PCI/DSS.

- Benefits for Customers: Confidence that their sensitive information is protected against breaches.

- Benefits for Insurers: Demonstrates commitment to security and compliance, reducing the risk of data breaches and penalties.

Why Insurers Choose 8×8 CPaaS

By combining robust features like fraud prevention, omnichannel messaging, enterprise integrations, and secure infrastructure, 8×8 CPaaS enables insurers to:

By combining robust features like fraud prevention, omnichannel messaging, enterprise integrations, and secure infrastructure, 8×8 CPaaS enables insurers to:

- Improve customer experience and engagement.

- Enhance operational efficiency and scalability.

- Meet regulatory and security requirements with ease.

With its adaptable architecture and focus on reliability, 8×8 CPaaS is the partner insurers need to thrive in the digital-first era.

The Future of Insurance Communication with 8×8 CPaaS

The insurance industry is at the cusp of a communication revolution, and 8×8 CPaaS is leading the charge. With omnichannel messaging, secure voice and video, and advanced features like authentication, fraud prevention, and enterprise integrations, insurers are set to transform customer experiences and streamline operations.

8×8 CPaaS delivers top-tier customer satisfaction, operational efficiency, and next-level security. As customer expectations shift, 8×8 CPaaS gives insurers the tools to stay ahead—modernizing communication, boosting retention, and shaping the future of insurance.

Ready to revolutionize your insurance communication? Discover how 8×8 CPaaS can help you adapt to the digital-first era or reach out to an expert at cpaas-sales@8×8.com.