Financial fraud isn’t just increasing – it’s getting smarter. And in an age where banking is digital by default, protecting customer trust is no longer a nice-to-have – it’s mission-critical.

The Philippine government has made its stance clear with the Anti-Financial Account Scamming Act (AFASA) and upcoming changes to the BSP’s IT Risk Management Regulations. By June 30, 2025 (based on BSP’s Draft Amendments to Regulations on IT Risk Management to Implement Section 6 of the Anti Financial Account Scamming Act), banks and financial institutions must implement stronger identity and fraud controls or risk falling behind – both in compliance and customer confidence. For banks and financial institutions, achieving AFASA compliance in the Philippines is now a top priority to stay secure and build lasting trust.

But for forward-thinking institutions, this isn’t just about playing defense. It’s a chance to deliver safer, smoother digital experiences that set a new standard. And that’s exactly where Descope comes in.

AFASA Compliance for Banks in the Philippines: A Quick Breakdown

AFASA requires banks to implement stronger authentication methods, real-time fraud detection systems, and strict safeguards against account takeovers. Core requirements include:

- Multi-layered, adaptive authentication mechanisms

- Real-time fraud monitoring using advanced detection tools

- Strict limitations on vulnerable authentication methods like SMS/email OTPs

- Mandatory biometric and passwordless authentication

How Descope Helps You Get There, Fast

Meeting AFASA’s requirements doesn’t have to mean adding more friction or building from scratch. That’s where Descope comes in – a platform designed to make secure customer experiences feel effortless, both for users and the teams behind the scenes.

Descope helps banks build flexible, secure and user-friendly authentication flows that adapt to real-world risks without overwhelming legitimate users. Here’s how:

- Biometric and Passwordless Login: Say goodbye to clunky passwords and unreliable OTPs. With Descope, users can log in through passkeys, social logins, or magic links – helping you boost security and reduce drop-offs.

- Real-Time Threat Detection: Block brute-force attacks, flag risky logins, and enforce step-up authentication for sensitive actions. Descope combines native risk signals (like VPNs or new devices) with third-party intelligence from tools like Forter and reCAPTCHA.

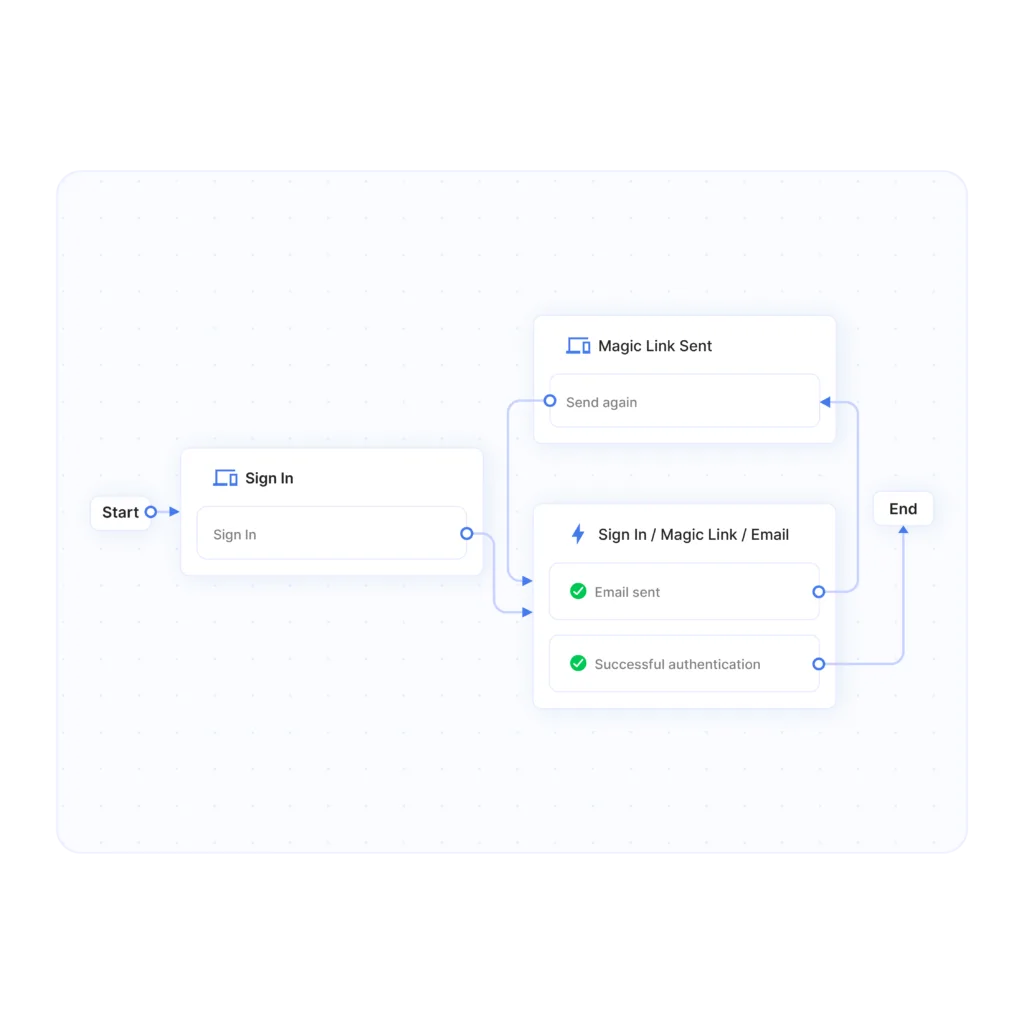

- Customizable, Drag-and-Drop Workflows: Build secure login and onboarding flows without deep backend work. Descope Flows lets your team visually map out and test authentication logic with speed and confidence.

- Plug-and-Play Integration: Whether you’re embedding into a legacy stack or launching a new mobile app, Descope offers SDKs and APIs that make integration simple across platforms.

- Fraud Prevention Ecosystem: Descope enhances your defense layer by connecting with Fingerprint (device ID + geolocation), Forter (behavioral risk scoring), and Traceable (API anomaly detection).

- Behavioral and Geolocation Monitoring: Spot anomalies in user behavior, location changes, or device tampering in real time, and respond before fraud escalates.

By combining strong security controls with seamless integration, Descope helps banks stay compliant and customer-centric – all while accelerating deployment timelines.

Whether you’re safeguarding account access or securing high-risk transactions, Descope helps you meet AFASA’s requirements while keeping user experience front and center.

Where Descope Fits in the Bigger Picture

Let’s be real: no single platform can cover every AFASA requirement. Transaction holds, money lock tools, and 5-year log retention still live in your banking core or back-end systems.

But Descope takes care of one of the hardest – and most important – pieces: securing access and stopping fraud at the source.

It’s the layer that keeps attackers out, gives trusted users a frictionless path in, and equips your teams to act the moment risk is detected.

Think of it as the frontline defense in your broader compliance and security strategy.

Descope in the Philippines

Descope is backed by 8×8’s local team based in our Manila HQ at World Plaza, BGC. With a track record of supporting Philippine BFSIs and cybersecurity initiatives you get hands-on guidance, faster support, and deep understanding of the local financial and regulatory ecosystem.

Building Trust Through Better Security

AFASA compliance isn’t the end goal – it’s just the beginning.

With Descope, banks in the Philippines can deliver customer-first, fraud-resistant digital experiences that go beyond checkboxes. You get security that scales, onboarding that converts, and compliance that doesn’t compromise experience.

Because real trust starts with access that feels effortless – and safe. Reach out to us for more details, or check out Descope to find out more.